It’s a major business challenge to maximise profitability from the cloud model. The good new¬s is that an 80-year old financial principle applies well to the demands of today’s cloud financing.

It’s called the Rule of 78.

Don’t worry if this is the first time you’ve heard of it, it’s a surprisingly simple concept to grasp. Created in 1935, the Rule of 78 was originally used in the banking industry to model the expected cash flows from interest across payment periods.

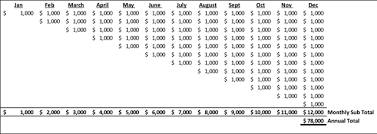

The chart below shows how the Rule of 78 applies to a subscription-based model where a new subscription is added every month. Where a traditional sales model would net 12 billing events for the entire year, with a cloud subscription model, the billing events grow exponentially. This results in 78 total billing events through the year (if you don’t believe us, count them).

So, in this example, where each billing is worth $1,000, the total revenue is $78,000 as opposed to $12,000 in the traditional on-premise model.

Rule of 78 and Your “Cloud Go-To-Market” Finance Strategy

So, what does an arcane banking model have to do with today’s cloud subscription investment planning? The investment models normally applied to gauge expected returns on traditional market opportunities tend to underestimate the lifetime value of subscription-based services to an audience that isn’t familiar with the nuances.

That’s where the Rule of 78 comes in. It’s a disruptive way to illustrate investment and expected returns of a subscription model. It enables all types of IT organisations to gain a clearer understanding of the financial complexities inherent when tackling the cloud opportunity.

It’s important to note that this application of the Rule of 78 typically results in the organisation breaking even after sales commissions are paid at the end of 12-16 months. Then, starting the following year, the organisation carries over those subscriptions’ net of attrition and continues to earn profit dollars with greatly reduced sales and administrative costs.

What to Look out for When Implementing the Rule of 78

Looking at the diagrams above, you may be wondering why more companies haven’t already switched over to a subscription-based plan.

Many IT organisations are hesitant to migrate away from traditional models because they’re accustomed to investment frameworks that support short-term cash flow from large one-time lump sum customer billings of service or product. Switching to a subscription-based plan challenges the core investment models these organisations use finance operations and growth strategies, as well as disrupting their expected cash flows.

Opportunities with the Rule of 78

Switching to a subscription-based cloud model doesn’t need to be an either/or proposition. Industry research suggests hybrid cloud will be the technology model of choice over the near term. So, it makes sense to adopt an investment strategy to support subscription profit flows alongside more traditional IT plans.

Some companies have switched all their products to subscription-based services in one go. Almost overnight, Adobe transitioned from selling annual software licenses to selling programs as a monthly subscription-based service. However, this isn’t the norm.

That’s the great thing about the Rule of 78 – it’s ideal in a “one-off” instance, supporting investment planning for a specialised business unit that focuses on cloud, while the wider business relies on existing traditional processes.

Is your company considering a major investment in cloud services delivery?

You can leverage TD SYNNEX’s comprehensive Cloud and Next-Generation technology portfolio, with the Cloud Solutions team. By gaining access to our commercial and technical enablement, end-to-end services and multi-cloud management, we’re putting you in control.

If you’re an existing partner and want to learn more about TD SYNNEX, or if you’re looking for a valued partner to help accelerate your business, get in contact with your local team today.

Share your own thoughts and experiences of transitioning into the subscription-based services and let us know what you think about the Rule of 78 financial model.